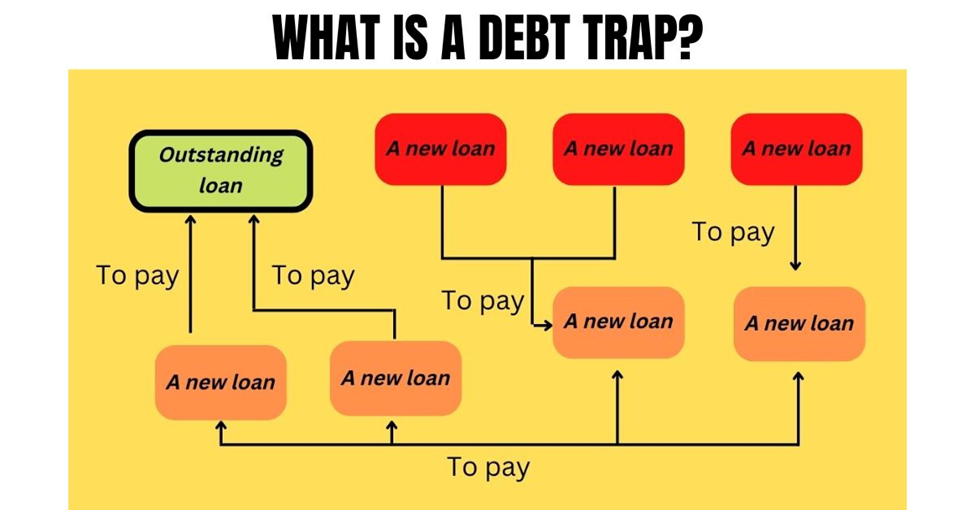

You are in a debt trap if your existing debt forces you to take another loan to pay the previous one. To escape a debt trap, consider not using multiple credit lines until it is the only way, as in an emergency. We all need a loan at some point in our life. Medical loans, study loans, and investment loans are sometimes necessary, and one should get these loans whenever needed. But taking a loan to repay another is where things start getting worse.

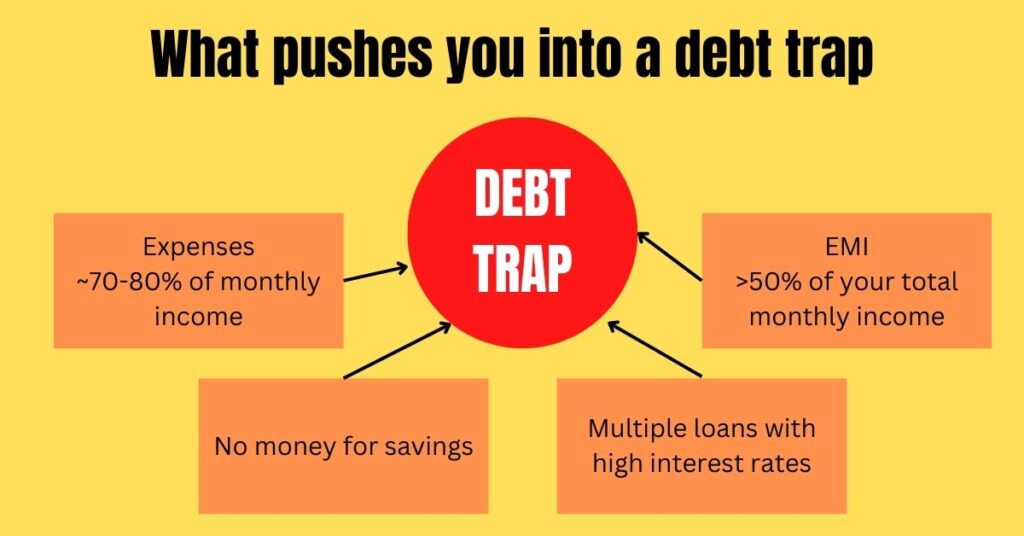

WHAT PUSHES YOU INTO A DEBT TRAP?

Here are a few things that can make things get out of hand and push you into a debt trap:

- Your expenses are 70-80% of your total monthly income.

- Your EMI (Equated monthly installment) is more than 50% of your total monthly income.

- You do not have any money for savings.

- You have multiple loans whose interest and EMI add up to a significant number.

Now the question is, how to get out of a debt trap? Here are a few tips to help you escape a debt trap and pay off your debt faster.

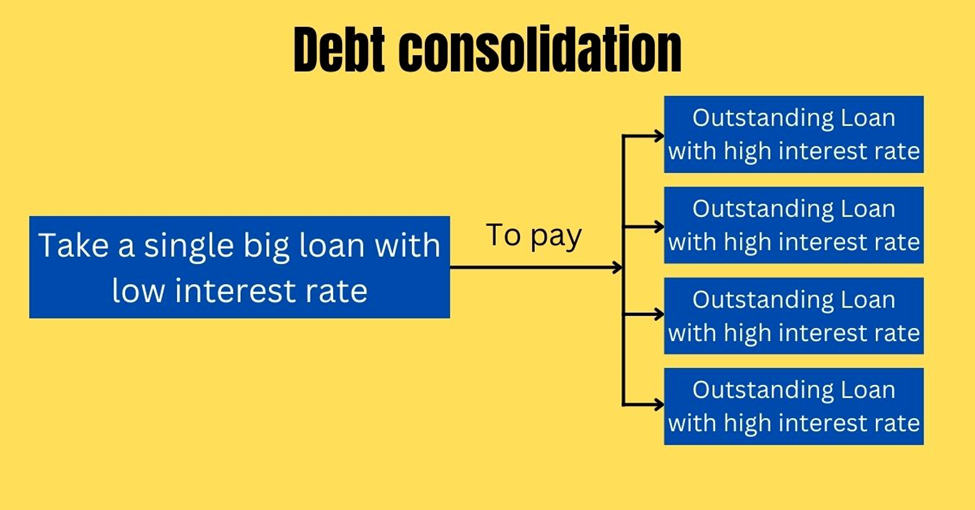

1. Debt consolidation; replace multiple debts with a single debt

Debt consolidation is a good strategy if you have various small debts to pay off. In debt consolidation, you take a large debt to pay off multiple small debts.

Why is debt consolidation a good strategy?

By taking a big loan to pay off small ones, you can avoid the headache of managing all the small loans. Whenever you decide to escape a debt trap, debt consolidation is one of the best ways to go. With debt consolidation, you need not worry about multiple debts, and you can focus on a single big loan and start repaying it.

You can borrow a big loan from a lender with the lowest interest rates, prioritize multiple small debts, and pay the ones affecting you the most with higher interest rates. A few good lenders in India that can provide you with loans to consolidate your debt are:

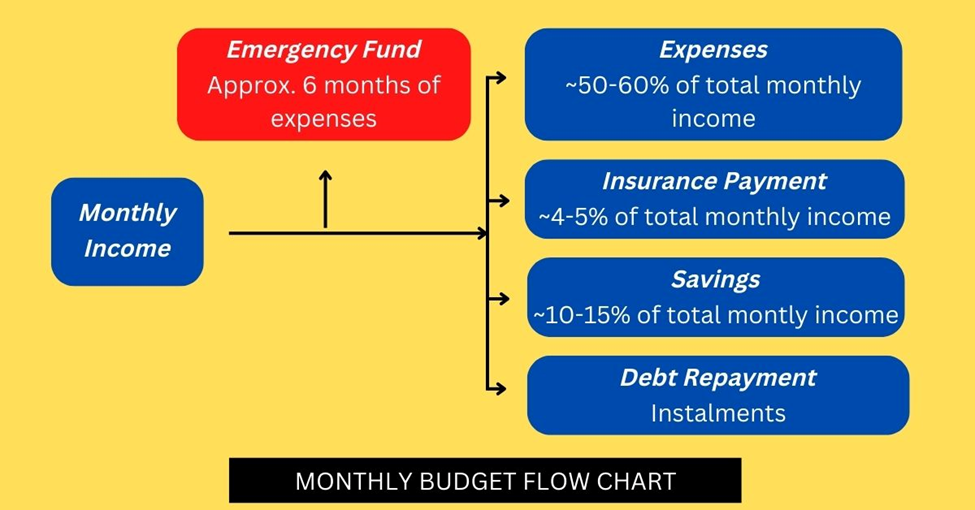

2. Devise a budget

To escape a debt trap, you should have a budget in place before you start spending. A budget allows you to keep track of your spending and expenses. You devise your budget at the start of a month and allocate spending to your different needs. With a budget, you have an estimate of how much you should spend on a particular thing.

- In your budget, you put aside an emergency fund to be used in case of an emergency. It is a great approach to go. In this way, you are not likely to take any loans in case of an emergency. You should set aside funds worth six months’ expenses as your emergency fund.

- With a budget, you might be able to save some money at the end of a month. You can open a saving account or invest in mutual funds. It allows you to earn fixed profits on your money.

- A budget helps in many ways. You can make partial debt payments, pay your insurance, and in the end, even save a small amount of money.

The flow chart below will help you devise your budget efficiently. You can adjust the chart according to your needs.

2.Prioritize your debt

We have already discussed the prioritization of debt briefly. But it needs further comprehension to give you a better understanding of what debt prioritization is. We broadly classify loans into short-term and long-term loans. Long-term loans, like home loans, have lower interest rates. On the other hand, short-term loans like personal and credit card loans have higher interest rates and fees.

Pay the short-term loans that cost you the most. Credit card loans may have an annual interest rate of 30%-40%. So you can avoid high interest on short-term loans by prioritizing their payment over long-term loans.

3. Keep track of your expenses

Someone takes a loan mostly when his expenses exceed his income. The best way to avoid taking debt is by keeping track of your expenses. Avoid spending on non-essential things that might cost you a large part of your monthly income. These non-essential things can range from luxurious purchases to movies and leisure trips to ordering food instead of cooking it at home.

Impulsive spending can be a huge factor in increasing your monthly expenses. With online shopping on the rise, you are prone to marketing traps and discount offers that can make you buy things you don’t need. You can avoid this trap by ignoring these discount offers and unsubscribing to stores that send you the marketing offers.

Most of this spending might not seem to affect your budget, but these small expenses can impact your budget substantially. Once you start taking control of your spending, you can save a significant amount of money each month. You can add this money to your emergency fund or savings account or repay your installments.

4. Extending your loan term

You can ask your bank to increase your loan term if you cannot pay your EMI payments. It is possible for long-term loans like home loans. No doubt it will increase the interest rate, but it will surely decrease the EMI payments, and you will have more time to pay your debt. You can even negotiate the interest rate with your bank and settle for the lowest possible rates. Even you can move your loan from your current bank to the one with the lowest interest rates. Avail of every opportunity available to reduce your interest rate and extend your loan term.

5. Look for a temporary side hustle

If you cannot keep up with your EMI payments after cutting your expenses and extending your loan term, try to look for a side hustle to make some extra money to help you repay your debt. Keep in mind that the side job is not permanent. After paying the debt, you can leave the side job and return to your previous routine.

A side job may be challenging and require a lot of time. But it will help you in your debt repayment a lot. You may find it frustrating, but in the end, you will see it was worth it.

6. Insurance Coverage

You should have sufficient insurance coverage for any medical or unwanted catastrophic crisis. Insurance will help you pay your debt without worrying about healthcare or other unwanted costs. Your insurance will cover unforeseen circumstances, and you can use the extra money to pay off your debt or move it into your savings account.

7. Use a credit card wisely

You should use a credit card wisely. Credit card loans come with high-interest rates, and using them can put you in huge debt. Consider the following things regarding the use of a credit card:

- Here wisely means using them when no other option is available. Ideally, do not make any purchases with a credit card. Minimize your online shopping, and when you do, use a debit instead of a credit card.

- You should pay your credit card loans as soon as possible. Do not pay the minimum amount (5% for most banks) because the remaining debt gets shifted to the next month with a higher interest rate. If you keep paying the minimum 5% of your debt, your debt will pile up for months, and it may become difficult to pay your credit card loan.

- Always pay full or partial credit card loans depending on how much money you have for debt repayment.

Keep your credit score above 750. With a credit score above 750, you may lower the interest rates on your credit card loan whenever you use the credit card.

8. Liquidate your assets

Paying debt can be challenging. It can put you under a lot of stress, especially when things get out of hand. You should assess the whole situation and consider if liquidating your assets is a good idea. You can pay your debt and throw away the debt sword hanging over your head. EMIs can be stressful, and getting rid of them gives you mental relief. After paying your debt, you can focus on saving the money to buy back your asset. Liquidating assets is not always a good idea, and the situation requires a complete assessment before taking any step, and you should liquidate assets only if necessary.

9. Avoid trapping yourself in debt in the first place

You can avoid falling into a debt trap in the first place. Minimize unnecessary spending and limit your monthly expenses to below or equal to 50% of your total monthly income. Avoid taking multiple loans with high-interest rates. Make a budget and stick to it. Pay your EMIs regularly and avoid using credit cards. Buy a secure insurance plan and set up an emergency fund to tackle unforeseen circumstances. Consolidate your debt to pay off high-interest loans. You will not fall prey to the debt trap if you follow these tips, and if you are in a debt trap, these will help you get out of it faster.

10. Get a higher paying job

You are stuck in debt trap and EMIs burdens are increasing then you should considering switching your job to increase your pay. Here you would get more take home salary and will have higher savings. One thing to note here that you must not increase the expenses with increasing salary otherwise your job switching will go in vain.

Follow above simple tips and get your debts reduced to great extent. If you liked this article then feel free to share it with your family, friends, and peers. Do share your thoughts on the article in the comment section below. Follow us on Instagram (wealth_drift) for valuable and easy-to-implement tips on personal finance.