The balance sheet is one of the three pillars of accounting. There are basically three financial statements Profit & Loss Statement, Cash Flow Statement, and Balance Sheet. We understand reading financial statements is difficult for the common man. Therefore, in this post, we will cover everything about the balance sheet in easy language. Before we go on how to read balance sheets, let us first understand what exactly a balance sheet is.

A. What is Balance Sheet?

A balance sheet is the statement of the financial position of a company which provides information about the company’s assets (resources) and its liabilities & equity (sources of capital) at a specific point in time.

A balance sheet is prepared on a quarterly or yearly basis depending upon law and company policy.

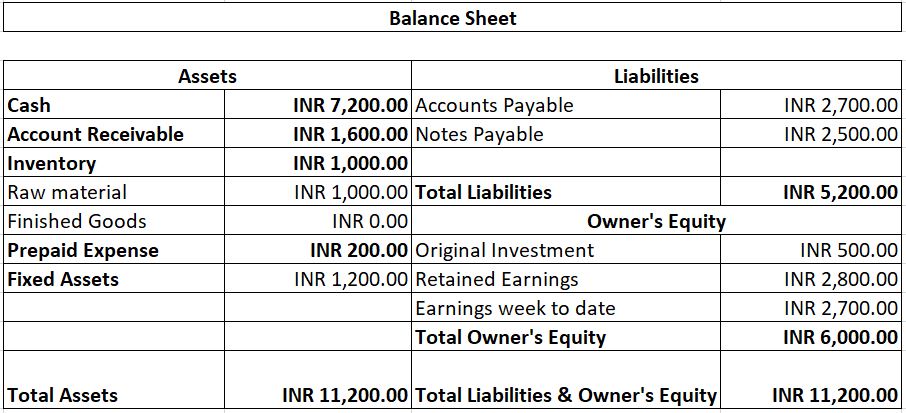

A typical example of a Balance Sheet –

B. What is the purpose of the Balance Sheet?

Whether you own a company or are an investor, understanding how to read and analyze information in a balance sheet is an essential financial accounting skill to have. Balance sheets along with Income and Cash Flow financial statements can be used to determine the health and durability of a business. It indicates exactly how much a company or organization is worth.

- It acts as an important tool for the investors to gain insight into what resources are available to a business and how they are financed and predict the company’s future performance basis which he can make his decision to invest in the company or not.

- It helps in Business owners/leaders/key stakeholders to make more effective decisions, policies, and better strategies for the future growth of the company: focusing more on successes and improving upon failures.

- External auditors use the company balance sheets to ensure a company is complying with every reporting law applicable.

- It is important for Company accountants to know how to read and analyze balance sheets so that they can avoid negative business outcomes in near future.

- It helps an analyst interpret a company’s ability to pay for its near-future operating needs, meet future debt obligations, and make distributions to business owners.

C. How to read Balance sheets using important ratios?

As the name suggests a Balance sheet has a balance between assets, liabilities, and equity. Basically, a balance sheet is divided into two parts. One side (part) contains a listing of company assets and another side (part) contains liabilities and equity. Balance means that both sides of a balance sheet are equal.

A balance sheet is based on below formula –

Assets = Liabilities + Equity

Let’s go one by one –

Assets

Assets are what a company uses to operate its business in the market. In the balance sheet, Assets are divided into Current Assets and Non-current Assets.

Current Assets – These assets can be converted into cash quickly typically in one year or less. Below are some examples –

- Cash or Cash equivalents: Physical currency, cheques, bank accounts

- Account receivables: Outstanding invoices that need to be paid by the company’s clients in the short term.

- Inventory: Raw materials, products in progress, and finished products

Non-current Assets – Opposite to current assets, these assets cannot be converted into cash quickly within a year. Below are some examples –

- Land & Property

- Equipment & Machineries

- Patents, Trademarks & Copyrights

Liabilities

Liabilities are the legal and financial obligations owed by the company to other institutions/businesses. Like assets, these are also reported as Current and Non-current liabilities in the balance sheet.

Current Liabilities – Obligations that are payable by the company in a year or less. For example –

- Payroll expenses / Employees’ Salaries

- Accounts payable: Outstanding invoices that need to be paid by the company in near future to other businesses.

- Current payment to long-term debts

Non-current Liabilities – Unlike Current liabilities, these are the company’s long-term obligations that are due in more than a year span. For example –

- Lease payments

- Long term debts

- Deferred tax liabilities

Equity

Equity is also termed Shareholder’s Equity/Owner’s Equity/Net Worth. It is the sum of the company’s original investment, retained earnings, and current earnings/losses. Equity decreases with company losses and increases with company profits.

Remember – Company liabilities and equity are two sources that support company assets.

A sample Balance sheet of company is as given below –

Read and analyze the balance sheets using important ratios

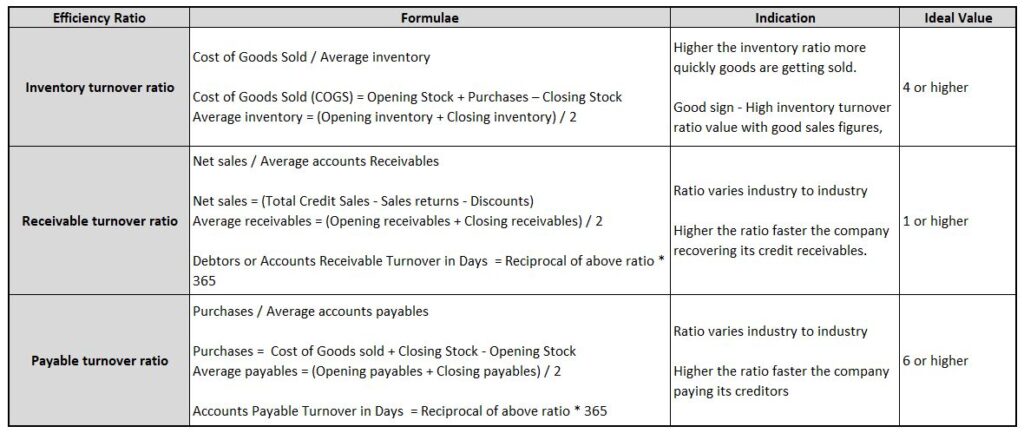

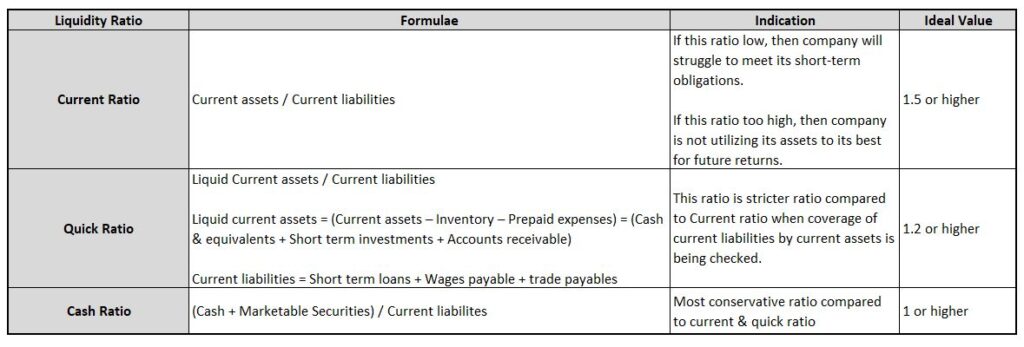

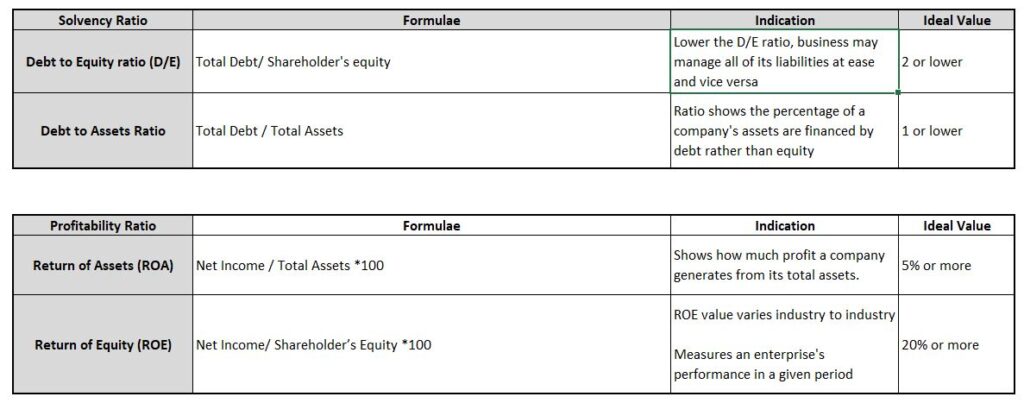

Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity (Quick, Current & Cash ratio), profitability, solvency, and debt-to-equity ratio.

Various useful ratios derived from a balance sheet:

As said earlier a balance sheet is one of the most important financial statements to determine the financial health of a company. Initially, you may take time in crunching the numbers out of the balance sheet for your use, however, with time and practice, you will become an expert at it.

If you liked this article then feel free to share it with your family, friends, and peers. Do subscribe us for new reads.