WealthDrift has come up with the 20 best personal finance books you must read to gain a good knowledge of personal finances. These books are instilled with good lessons for all kinds of people who want to start or already started their finance journey and want to succeed in their lives and also make it big. Here we go with the 20 personal finance books –

1. The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

Written by: Thomas J. Stanley and William D. Danko

In this book, the author talks about the habits of rich people to show how they save, spend and invest their money. As per the author, the wealthy does not always show off their money with luxury cars and designer clothes, in fact, choose to live below their standard. You can read this book if you have entered into the realm of personal financing.

2. Total Money Makeover

Written by: Dave Ramsey

In this book, the author tells over 50 real-life stories of debt pay off. The author tells a simple 7 step plan for getting out of debt and saving for emergencies and retirement. Also, in the book on personal finance author recognizes the 10 most dangerous money myths that hinder a person’s financial growth.

3. Rich Dad, Poor Dad

Written by: Robert T. Kiyosaki

Robert Kiyosaki compares his two dads in this book, Rich Dad and Poor Dad, how their views vary from each other on money and wealth. The author stresses upon that one should work for learning instead of earning. He also explains five roadblocks to success which are Fear, Cynicism, Laziness, Bad habits & Arrogance. This book is also a very good start if your new to personal finance.

You can read the article on Top 10 lessons from Rich Dad Poor Dad book. Click here to read

4. The Richest Man in Babylon

Written by: George S. Clason

This book emphasizes saving money over spending, protecting it, and further growing it more. The author in great depth talks about the ways one can accomplish personal wealth and offers a thoughtful solution to personal finance problems. The author also wants us to follow the budget 10/20/70 rule for better managing of our personal finances –

10% – Paying to self and saving for future investments.

20% – Pay off your debt with this money as early as possible even when you are broke.

70% – Pay for your necessary expense such as food, home, clothes, charity, and joy.

You can read the article on Top 10 lessons from The Richest Man in Babylon book. Click here to read

5. The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

Written by: John C. Bogle

In this book, the author explains various stock-picking techniques and the basics of investing. The author also focuses on index funds for investing. The book is filled with the best practical advice and in-depth insights on how to apply proven investment strategy into your investment portfolio for the best returns.

6. The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life

Written by: JL Collins

This book is originally written by the author as a series of letters advising his daughter on personal finance. In this book, the author shares his philosophy of investing and advises us to stay away from complex and enticing investments. He also shares the basic wisdom in the book that we need to make our money work for us, not against us to build our wealth. He also explains what stock really is and why most people lose their money in the stock market.

7. Secrets of Millionaire Mind: Mastering the Inner Game of Wealth

Written by: T Harv Eker

In this book, the author talks about achieving success using blueprints of your money in subconscious minds. As per the author, those blueprints determine your levels of success. If they are not big enough you won’t make big money in life. The author further explains you are poor because you think like a poor person and vice versa.

8. Think and Grow Rich

Written by: Napoleon Hill

The author wrote this book after interviewing a series of millionaires and philanthropists. The author in this book focuses on the mindset behind building wealth. He also highlights the importance of planning and budgeting for building wealth. And, thereafter explains the importance of DESIRE & PERSISTENCE in the accumulation of a fortune.

9. Broke Millennial: Stop Scraping By and Get Your Financial Life Together

Written by: Erin Lowry

Best for millennials, this book touches upon those young adults who are dealing with huge student loan debt and wants to get rid of them. In this book, the author shares personal finance lessons for beginners. The author as a motivating guide also made things easy for young adults who are confused about debt, budgeting, and beginning to plan for the future.

10. You are a Badass of Making Money: Master the Mindset of Wealth

Written by: Jen Sincero

In this book, the author looks at the mindset required to earn and keep the money. This book is designed to help you drop those financial habits that hold you back from success. And introduces some easy concepts that will help you to improve upon your personal finances and also the way you handle the money.

11. Secrets of Six-Figure Women

Written by: Barbara Stanny

Like many other books in this article that focuses on mindset building, this book also breaks down the mindset of successful person. The author has interviewed high-earning wealthy women of various professional backgrounds and provides a new set of lessons in her book for those who want to boost their net worth. This book is perfect for working women who want to get inspiration from other successful women to better personal finances.

12. The Wealthy Gardener: Life Lessons on Prosperity between Father and Son

Written by: John Soforic

This book is written by a financially independent father for his financially dependent son. The author provides a glimpse of lives where the father teaches his son how to pursue his goals and interests. In this book, the author teaches various lessons to build and sustain wealth. He also talks about ways to overcome the hurdle that land you into a debt trap and wage slavery.

13. The Millionaire FastLane: Crack the Code to Wealth and Live Rich for a Lifetime!

Written by: M. J. DeMarco

In this book, the author points out that working hard for saving 10% throughout your life and retiring at 65 is stupidity. Instead, tells you to focus on retiring rich early and enjoy your life to the fullest. The author tells you to be producers, not consumers, and unlink your income from your time required to make it if you want to become rich. Fast lane may be fast to make you rich, but understand there are no shortcuts to success.

14. The Intelligent Investor

Written by: Benjamin Graham

This book is proved to be the blueprint for first-time investors and beginners on the personal finance journey. The author explains value investing which is focused on making steady long-term profits. He makes you understand the 3 principles for intelligent investing: analyze for the long-term, protect yourself from losses and never go for crazy profits.

15. Security Analysis

Written by: Benjamin Graham and David Dodd

This book is actually the bible of equity investing. In this book, the author explains various methods and techniques of value investing. This book also provides various lessons on how to find which securities (bonds/stocks etc.) are good for investing. You will learn how to check a company’s soundness before investing in it and learn to find real investments which will keep your principal safe besides offering a decent return.

16. The Bogleheads’ Guide to Investing

Written by: Taylor Larimore, Mel Lindauer, Michael LeBoeuf, and foreword by John C. Bogle

This book is full of finance and investing lingo and book recommended to people who are starting with investing. The author tells you the essentials of successful investing and strategies to follow to make good investment returns. The author also stresses index investing in this book explaining their several advantages.

17. The Automatic Millionaire: A Powerful One-step Plan to Live and Finish Rich

Written by: David Bach

This book enables you to set up systems to build wealth. The whole idea prescribed by the author is to get rich by paying yourself first and thereafter, automate the process of wealth accumulation so that you can have a secure future tomorrow. This book also helps to identify areas where you unconsciously use your money and how those little expenditures can be used to make your financials stronger.

18. Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

Written by: Joseph R. Dominguez, Monique Tilford, and Vicki Robin

In this book, the author focuses on a person’s emotional response and how he thinks about money. This book supports the idea of living frugally to live happier. It also advises to become financially independent, from the mindset requires to the investment moves you should be making for better returns.

19. The Money Book for the Young, Fabulous & Broke

Written by: Suze Orman

In this book, the author helps millennials to understand the basics of personal finance, like coping with huge student debts, job market, credit card, and insurance, etc. The author communicates straight to those who need help to deal with finance issues, a financial plan for the first time, and people who are suffering from so-called ‘Generation Debt’.

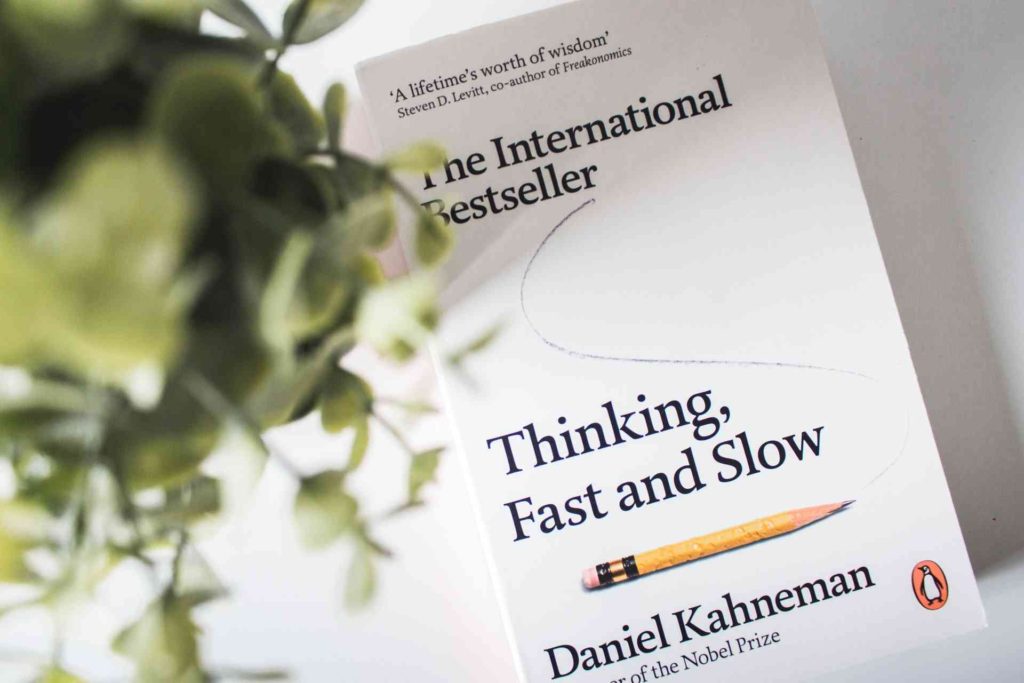

20. Thinking Fast & Slow

Written by: Daniel Kahneman

In this book, the author explains two types of thought processes of our mind that drive the way people think. System 1, which is fast, intuitive but emotional and System 2 is slow, its operation but more logical and deliberate. Nevertheless, the author recommends us to use System 2 when making decisions about money and leave our emotions at home.

We recommend you to read the above books on personal finance to better your personal finances and amass personal wealth. Any thoughts on the article are always appreciated, feel free to share your thoughts in the comment section below.