You would learn the basics of accounting from this book, ‘The Accounting Game: Basic Accounting Fresh from the Lemonade Stand’ by Darrell Mullis and Judith Orloff.

Author(s), in their unique childish way, makes us understand the basics of accounting by telling a story of a 9-year-old boy who set up a lemonade stand and does its finances on his own.

WealthDrift tries to cover all the important key points that the author wants to highlights. So, without further ado, let’s start –

1. Three (3) Pillars of Finance

1.a. Balance Sheet – It is the report made at a particular moment of doing business (Like a picture/snapshot of the business at an instance of time).

1.b. Profit & Loss Statement – Also known as Income Statement or Operating Statement. It is the report that tells the flow of events that happened during the entire financial period (The period could be a week or a month or a year).

1.c. Cash Statement – It is the report for all sorts of transactions done in cash. It gives an idea about how good a company managing its cash.

2. Methods of Accounting

2.a. Accrual Method of Accounting – In this type of accounting, we account for everything as it happens i.e. we account when we earn something or we owe something or we use something. This method is more favorable in terms of showing to banks/investors as it shows more profit, provides the true picture of earning.

E.g. any business with inventory usually can only use this method.

2.b Cash Method of Accounting – In this method of accounting, we only account for cash currency transactions. It can be beneficial if you want to defer some taxes to next year and pay those taxes with inflated currency.

E.g. Service businesses, consultants, lawyers, doctors, accountants, etc. can use this method.

- However, the most favorable method is Accrual Method as it gives a true picture of earnings. One can also choose to do both kinds of accounting (Accrual for investors/banks and Cash for Tax Authorities). This type of accounting is known as Creative Accounting.

- Accrual accounting leads to higher taxes due to higher profits, however more accurate. High inventories companies can only use Accrual accounting otherwise those companies, by Cash Accounting, could easily hide their profits by spending cash on buying inventory and reduce reported earnings.

Let’s dig deeper into the book and learn more on accounting terms in detail –

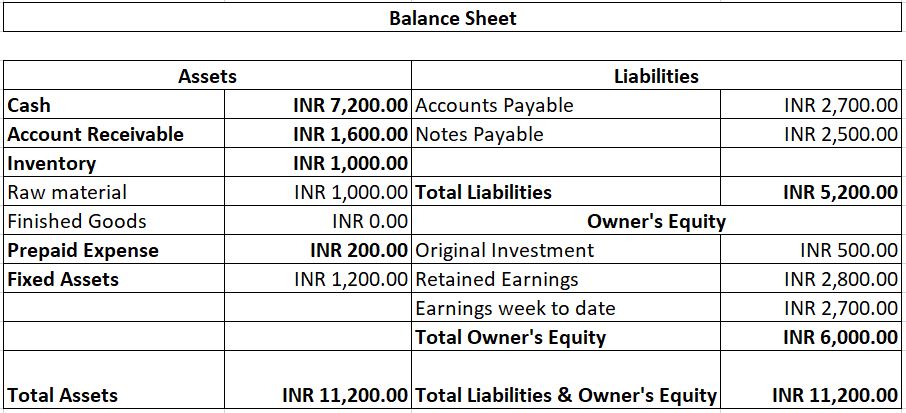

A. Balance Sheet

We already defined a Balance Sheet above, now let’s focus on what it consists of. A Balance Sheet has two sides, left and right. Usually, on the left side, we enter “Assets” and the right side “Liabilities and Owner’s Equity”

A.1. What are Assets?

Assets would be any of the followings or all –

Cash – Present currency in your hand

Inventory – Raw Material – Purchased raw material to make the final product.

Finished Goods – Final produced products ready to sell.

Note – Companies consider Inventory as an asset.

Account receivables – Amount your customer owes to you i.e. amount of product you sold to your customers on credit, usually on trust. If somebody who owes this money to you, does not pay it back to you then it is will be booked as Bad debt in financial records.

Prepaid Expense – Expenses wherein we have already paid money in advance for something that has value in future accounting periods. E.g. Advance paid unused insurance.

Let’s say you buy an insurance premium of INR 30,000/- for 3 years (i.e. INR 10,000/- per year). Then your prepaid expense would be INR 20,000/- in the 1st year of accounting.

Fixed Assets – These assets are long-term assets, and are not intended for sale and used repeatedly during the course of doing business, which has a life of more than 1 year. E.g. Real Estate, plant, equipment, etc.

To know more about Real Estate, you can go through this article. Click here to read

Current Assets – These assets are liquid assets, which have a life less than 1 year i.e. can be converted into cash within 1 fiscal year. E.g. Cash-in-hand, Account Receivables, Inventory, etc.

Note – Generally, the purchase of major items of significant value increases your assets.

A.2. What are Liabilities?

Liabilities would be any of the followings or all –

Accounts payable – Amount you owe to your suppliers, vendors, etc. Accounts Payable means we got goods or services from our suppliers or service providers on credit.

Notes Payable – Amount you owe to bank or other financial institution as a loan. Notes Payable means we got cash from our lenders for a certain long period.

Tax Liability – Amount you have to pay on your earnings as taxes to the government.

A.3. What is Owner’s Equity?

Also termed as Equity, Stakeholder’s equity, or Net Worth. It is actually the Original Investment, Retained Earnings, and Earning week (specified period) to date, of the owner(s).

Two rules of Accounting –

Rule 1 of accounting – Left side is always equal to the right side (We are referring to Left Side – Assets & Right Side – Liabilities & Owner’s Equity)

Rule 2 of accounting – Basic Financial equation: Assets = Equity + Liabilities

A typical example of a Balance Sheet –

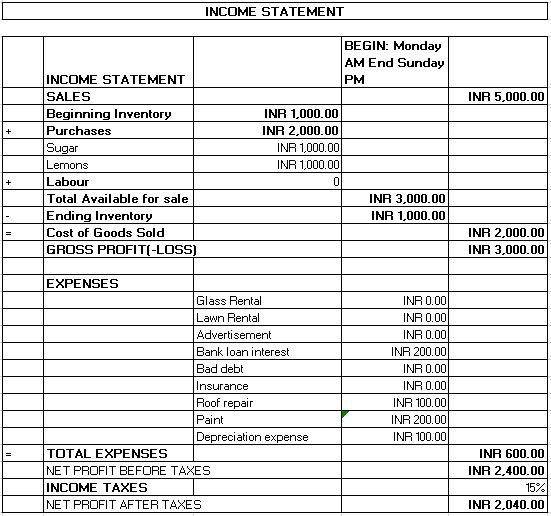

B. Profit and Loss (P&L) Statement

Again defining it briefly, it is the report that tells flows of events that happened during a fiscal year. P&L statement contains below terms –

B.1. Gross Sale (GS)

It is the sales your business or company has made during the financial period.

B.2. Cost of Goods Sold (COGS)

It is the actual cost of production of goods/services.

B.3. Inventory

Inventory is purchased raw materials or finished products ready to sell.

The author discusses two (2) methods of valuing the Inventory –

i. First in first out (FIFO) – This method of inventory accounting assumes that raw materials that were purchased earlier were first sold as final products.

ii. Last in first out (LIFO) – This method assumes that raw materials that were purchased later were first sold as final products.

Note – i. LIFO understates the profits, therefore, governing financial bodies usually prohibit LIFO. Because the only reason a business would choose LIFO is to save/defer taxes, let’s say when prices are rising, LIFO accounting will value COGS higher, in turn, reduced profits and less applicable taxes.

ii. There is a special section called Footnotes in the company’s financials wherein the company is required to reveal the method they used to value the inventory.

iii. There could be the case of overstated assets in the books because there might be chances that inventory has been outdated, cannot be used to produce the product, still counted as assets.

B.4. Expenses

It is the cost incurred to a business other than the cost incurred producing your goods/products. Overhead Cost/Indirect Expenses, lawn rental, advertisement, etc. are different types of expenses. Expenses are also known as the Cost of doing business. They are reduced from “Earnings Week or any specified period to Date”.

E.g. Equipment Rental, Lawn Rental, Advertisement, Bank loan interest, Bad debt, Insurance, Any Construction repair, Paint, Depreciation expense, Salary expense, etc.

B.5. Depreciation

Depreciation is a non-cash expense. Author(s) discussed the method below to calculate depreciation –

Declining Balance Depreciation- In this method, businesses depreciate their assets at a higher rate in the initial years than in the subsequent years. Because assets are usually more productive when they are new and their productivity decreases with time.

There is a 200% Declining balance method (also known as Double declining balance) wherein the depreciation rate is 200% and a 150% Declining balance method where the depreciation rate is 150%. Let’s understand it from an example –

Asset Value of an asset = INR 20,000/-

Salvage Value = INR 4,500/-

Useful life = 5 years

Straight-line depreciation = 1/5 = 0.2 i.e. 20%

200% Declining Balance depreciation = 2 * 20% = 40%

Depreciation = 40% * INR 20,000 = 8,000/-

i.e. After 1st-year Asset value of the asset will be INR 12,000/-

The author(s) also discussed another method such as MACRS (Modified Accelerated Cost Recovery System) which is the current tax depreciation system in the United States.

B.6. Gross Profit

GS – COGS or Cost of Services – Expenses

Gross Profit goes under “Earnings Week To Date” under Owner’s Equity.

B.7. Net Profit (Also known as Bottom Line/ Net Income/ Earnings)

GP – Taxes

A typical example of an Income Statement –

Note – Businesses create what’s called a GENERAL LEDGER, which is a moment-by-moment record of everything that happens. This is done to organize the information(s) so that it can be found easily.

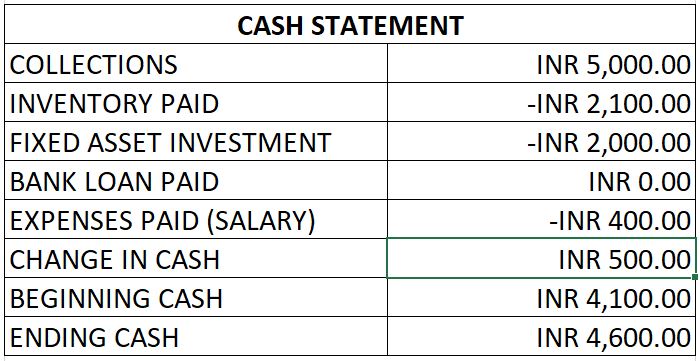

C. Cash Statement

It only records the cash flow in a given period. It basically tells that how well a business managing its cash flow. Actually, cash runs the business daily, not your earnings or retained earnings as these are tied up in assets/equipment, etc.

Earnings are not the cash or sum sitting in your bank and the same with profits, they are also theoretical and do no equal cash too. So, it is very important to keep cash around, therefore, a cash statement becomes very important in this aspect.

You will now be able to understand basic financial terms and concepts like assets, liabilities, earnings, inventory, notes payable, etc.

If you liked this article, please do comment in the comment section below and share this article with your family and friends.

Hi to every one, the contents existing at this website

are really amazing for people experience, well, keep up the good work fellows.

I think this is one of the most significant info for me.

And i’m glad reading your article. But wanna remark on some general things, The site style is

ideal, the articles is really excellent : D.

Good job, cheers

I enjoy what you guys are usually up too. Such clever work and coverage!

Keep up the great works guys I’ve added you guys

to my blogroll.

Thanks for sharing your thoughts. I truly appreciate your efforts and I will be waiting for your further write ups thanks once again.

I like what you guys are usually up too. Such clever work and coverage!

Keep up the very good works guys I’ve included you guys to

my blogroll.

I appreciate, result in I found just what I used to be taking a look for.

You have ended my 4 day lengthy hunt! God Bless you man. Have a great day.

Bye

This is a great tip particularly to those fresh to the blogosphere.

Simple but very accurate info… Thank you for sharing this one.

A must read post!

Greetings! Very helpful advice in this particular article!

It is the little changes which will make the greatest changes.

Many thanks for sharing!

Here is my web site :: CBD for dogs

Hi! This is my first comment here so I just wanted to give a quick shout out and

say I genuinely enjoy reading your posts. Can you recommend any other blogs/websites/forums

that deal with the same topics? Thanks a lot!

Hi Reader,

Thanks for reading our article.

You can follow the outbound links we mention in our article sometimes.

Regards,

WD Team

You can certainly see your enthusiasm within the article you write.

The sector hopes for even more passionate writers like you who are not afraid to mention how they believe.

Always go after your heart.

I really like it when people get together and share views.

Great website, keep it up!