The present-day investors are surrounded by a wide range of investment options. It is difficult to maintain the right mix of asset classes with high reward and low risk. The focus is always on how to choose the best asset allocation (Stock-Bond-Cash) that will help in planning and achieving long-term financial goals. Hence, selecting a prudent investment portfolio here becomes the key to long-term wealth creation.

High reward opportunities are very attractive to someone who wishes to grow money. However, learning the difference between a good portfolio mix and a bad portfolio mix is often overlooked by many.

Here, at WealthDrift, through this article, we aim to simplify the process of picking the best asset allocation model for you based on your goals and risk profile. We will cover the following in this article –

- What is asset allocation?

- What are the 3 major asset classes?

- Factors to consider before starting asset allocation.

- Choose the best asset allocation model.

- Why reviewing and rebalancing is important?

- Conclusion

A. What is Asset Allocation?

Asset allocation is an investment strategy that divides an individual’s investment portfolio between different asset classes balancing the risk and reward according to individual’s age, goals, risk tolerance, and investment time horizon.

Diversification between different asset classes can mitigate risks to a large extent. It also explains the old adage “Do not keep all eggs in the same basket”. The portfolio mix which we are talking about includes stocks (equities), bonds, and cash or cash equivalents. The final goal is to maximize the returns from assets in light of your level of risk tolerance.

B. What are the 3 major asset classes?

A good strategy suggests diversifying your holdings that are investing in a mix of stocks, bonds, and cash. Different assets perform differently in similar economic situations. Let’s understand briefly the 3 major asset categories.

1. Stocks or Equities

Stocks or Equities are the shares of a public listed company that are traded in the market. This asset class comes inherently with risk. Because it does not provide guaranteed income and also it is subject to market fluctuations. On basis of market capitalization, this asset class is further divided into small-cap, mid-cap, or large-cap stocks. Returns from stocks are higher in all 3 asset classes.

You can read our article to know more about terminologies in stock market that an investor needs to know. Click here to read

2. Bonds or Fixed income investment

Bonds are a fixed income instrument in which an investor lends money to a borrower (a corporate or a government firm) as a loan. Here, the investors or debtholders, are paid returns in form of fixed interest rates.

It is a lower-risk asset class because of the fact that you would not lose your invested money. In addition, you will earn returns assured at the time of investing. However, returns here are lower as compared to stocks. Hence to pace up the growth of your money with inflation, you need to invest some amount in stocks also.

3. Cash or cash equivalents, or money market funds

This asset class has the highest level of liquidity which is its primary advantage. Here, money held can be used and accessed at any point in time without any restrictions. This can be idle money in your savings account or any liquid funds. It offers negligible returns and hence cannot beat inflation.

Additionally, there are other asset classes as well, such as Real estate or other tangible assets, commodities, other financial derivatives, etc.

You can also read our article to know more about real estate and related terms. Click here to read

C. Factors to consider before starting asset allocation

The process of setting a target asset allocation model starts with taking the following factors into consideration. It will help you to find a good portfolio mix that works best for you at any given point in life.

1. Age

The purpose behind asset allocation by age is to gradually reduce the risk exposure over years. So, at the time of retirement, you have a reasonable amount of money secured in the same investments.

There is a very common Rule of Thumb among investors which states that individuals should keep ‘100 minus their age’ percentage of the amount in their equities and rest in bonds or cash. The idea is to have steady cash flow in the late 40s and 50s. However, Young investors can invest a major portion of their money in equities (stocks) because of having high risk-taking capabilities.

2. Goals and Years of investment

Before choosing your investment portfolio, you should identify your financial goals and how much time you have to reach these goals. For example, if you are planning for house construction within 2 or 3 years, you cannot afford to invest more of your money in higher-risk assets like stocks. Your portfolio should majorly include lower-risk assets like bonds. This will help you to protect savings from inevitable ups and downs of the market.

However, in the case of medium-term goals (3 to 5 years) or long-term goals (greater than 5 years), you can shift from bonds to stocks or hybrid investment. Your asset allocation changes with the number of years or months you will be choosing to reach your financial goals. If you have a longer time horizon, you can afford to invest in riskier and volatile investments in order to get desired returns.

3. Risk Profile

An individual’s risk profile is his ability and willingness to take risks. Even if two persons have the same investing time horizon, their asset allocation model will be very different because of risk tolerance. You should always do the analysis of few investment strategies and check how will you react if the market crashes.

For example, if you invest major chunks of your money in stocks let say 70% to 80%. How would you feel if the market crash happens and your stock’s value goes down by 50%? There could be a case when you would sell your assets to avoid further losses out of panic, so in that case, your risk tolerance is low.

On the contrary, if you are an aggressive investor and think to buy more when prices are lower, then you have a high-risk tolerance and you can invest high chunks in equities.

4. Income stability

Above 3 are the main factors for choosing the right portfolio mix. But looking at the current economic crisis due to pandemic, income stability also becomes an important factor in deciding your asset allocation.

Person A who is salaried and Person B who is an entrepreneur can have vastly different asset portfolios even if they have the same risk profile, goals, or time horizon. This is because Person B may suffer irregularities in his cashflow during crisis times. Hence someone like Person B should have more investments in liquid funds or bonds.

D. Choose the best asset allocation model

Based on your risk capacity and risk tolerance, there are few allocation models which we are going to discuss, ranging from a very conservative portfolio to a very aggressive portfolio.

To understand more clearly, you need to know what is your risk appetite, risk tolerance, and risk capacity.

- Risk appetite – The amount of risk an investor is willing to take to support his financial goals.

- Risk Capacity – The amount of risk an investor is able to take based on his income levels, debts, etc.

- Risk tolerance – The limits of risk or losses an investor can withstand and is comfortable taking in his financial planning.

Below are the types of portfolio mix which you can choose as the best asset allocation model for you-

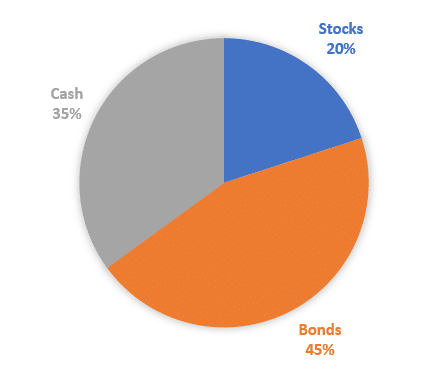

Type 1: Very Conservative portfolio

- Preferred for short-term goals.

- Stocks: Large-cap stocks.

Type 2: Conservative portfolio

- Preferred for short-term goals.

- Stocks: Blend of large-cap and mid-cap stocks.

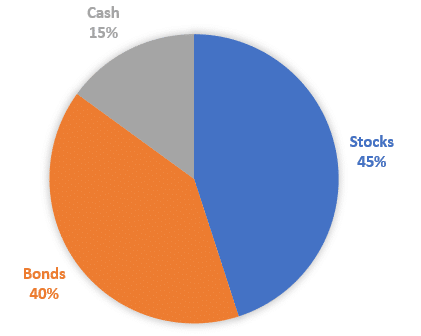

Type 3 : Moderate/Balanced portfolio

- Preferred for short-term and mid-term goals.

- Stocks: Blend of large-cap, mid-cap, and small-cap stocks.

Type 4: Aggressive portfolio

- Preferred for Long-term goals.

- Stocks: Blend of large-cap, mid-cap, and small-cap stocks.

Young investors who are under 30 years of age usually choose this type as the best asset allocation model for themselves.

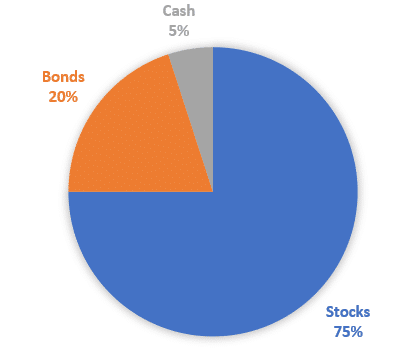

Type 5: Very Aggressive portfolio

- Preferred for long-term goals.

- Stocks: Blend of mid-cap and small-cap stocks.

E. Why reviewing and rebalancing is important?

When your desired asset allocation mix is finalized and running, you should review and rebalance your allocation after a regular period of time. This is necessary, because a lot of time, you will notice that some of your assets have outperformed and now are out of alignment with your original portfolio mix. In that case, in order to maintain your portfolio ratio, you should make adjustments at fixed intervals or when you see your assets are out of balance.

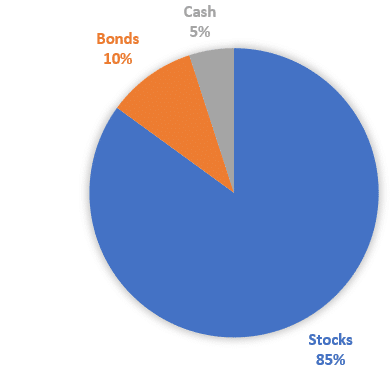

For example, let suppose you invest 80% of your money into equities and 20% in bonds. Over time, your assets after gains now are 85% equities and 15% bonds. In this case, you need to sell some of your equities to get back to the original portfolio. Good returns are always desirable, however, there is always a risk due to the ups and downs of the market. Hence by regularly reviewing and rebalancing you can return back to your comfortable level of risk tolerance.

F. Conclusion

Right Asset allocation plays a very crucial role in an investor’s life. Investment strategy need not be complicated every time. There are a wide variety of asset options today. An investor should always first consider multiple factors and choose his/her optimal asset allocation model which can protect them in periods of economic crisis.

Hope we have tried our best in this article “How to choose the best asset allocation model ?” to explain the process of finding the right portfolio mix for you in the very simplest manner. Please share this article if you liked it and put your suggestions in the comments section below.