This time at Wealthdrift, we bring you a very interesting article on the most desired and craved asset in India i.e. Gold. This yellow metal is considered a symbol of prosperity and wealth for ages. Often cherished by women in India in the form of gold jewelry, it also fascinates investors worldwide for the variety of ways to invest in it.

Before making any investment choice, you must first have a clear ‘why’ for the option you are considering. Therefore, in this article, we will try to cover everything from ‘Why to consider Gold as an investment option’ to ‘How to invest in Gold in India’.

A. Why to consider Gold as an Investment option?

From ancient civilizations, Gold has been a luxury good. If you see in history, Gold was the first choice of currency in many countries and was circulated among them as currency before the introduction of paper money. However, there has been a shift in the usage of Gold from past to present. Today, there are 2 types of people who put their money in Gold on basis of their usage –

a) Consumers – These are the people who buy Gold for their consumption. For instance, these people buy gold in form of jewelry.

b) Investors – There are people who consider Gold as the option to achieve their investment objectives. Hence, these people use their money to invest in gold, speculating its prices in the future.

With this difference, let’s find out the reasons why people tend to invest in Gold.

1. Inflation Hedge

Gold is considered to be a good hedge against inflation. The value and purchasing power of a currency loses their value with the rise of inflation. Due to this, people tend to hold money in the form of Gold. Hence, Gold acts as an inflation hedge in the long run because the value of gold goes up when the inflation rate is above the interest rate in a country.

2. Portfolio Diversification

As financial experts suggest, gold can prove to be a good asset option for the perfect diversification of your investment portfolio. This is because gold prices do not get affected by microeconomic factors (suppliers, customers, competitors, etc,) unlike other asset classes. Hence maintains the risk tolerance of an investor.

3. Low Volatility

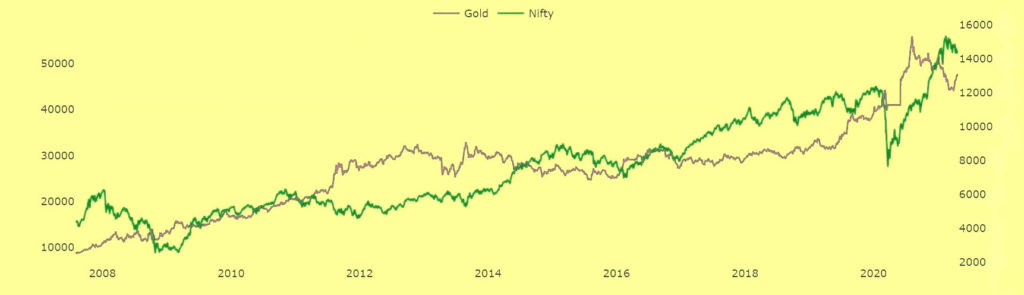

Due to lower volatility of Gold than equity investments, Gold has proven to be a superb performing asset in times of economic crisis in India such as the Global financial crisis (2008), European debt crisis (2011), Covid-19 pandemic crisis(2020), etc. Whenever the returns from NIFTY have gone down in India, Gold returns have gone up.

4. High Liquidity

Gold has higher liquidity which means you can easily liquidate gold investment anywhere and anytime. The value of gold will never go to zero.

B. What is the right time to invest in Gold?

The prices of gold have fluctuated significantly in the past 20-30 years, however, have given positive average returns of 8-11% over this time period. If you see in the past 1 to 1.5 years i.e. since the beginning of the year 2020, Gold alone has marked a significant rise in its returns i.e 25-28%. And, the same investment in gold before a year was performing average.

Hence it is very much clear that while considering gold as an investment option, the timeline on investment plays a very important role.

1. Demand-Supply ratio of Gold

In stocks, real estate, or farmland, there are various businesses or underlying assets under these instruments which generate income and hence increases the value of these assets. But, Gold is a commodity i.e. there is no income-producing asset in gold. So, here the reason for the ups-downs of gold prices is particularly the Demand-Supply ratio of gold. When the demand is more i.e. when people buy more gold for example during festivities in India, the gold price goes up.

2. Economic health of country

With the historical graph analysis of NIFTY and Gold given below, it is evident that whenever there is any economic crisis in the country, the share market drops down and gold prices drastically go up.

If you had this yellow metal in your portfolio at the beginning of the year 2020, you would have received 25% returns today. That is to say that this might be the maximum returns among any of the instruments in the market.

Hence, the timeline of investing in gold should be analyzed thoroughly based on the gold supply-demand and economic conditions of a country.

You can read our article to know more about basic terminologies in Stock Market that an Investor needs to know. Click here to read

C. What percentage of your portfolio should comprise of Gold?

Ideally, financial experts suggest keeping gold as 5% to 10% of your investment portfolio. This is backed by the fact that gold is not a wealth-creating asset, however, it has proved to be a good hedge against equity markets downfall and inflation from the historical data. In addition, in the long run, it has been able to provide good average returns of 8-11%.

You can read our article to know more about asset allocation and diversification. Click here to read

D. How can you invest in Gold in India?

Today, gold is just not limited to jewelry or ornaments buying. In contrast, it has covered different options of investment. These days you get options to buy gold, either in physical form or in digital form. Below here are all the 5 available investment options of Gold –

1. Physical Gold – Gold is bought traditionally in physical form as jewelry, coins, bars, bullions, etc. This form has various risks attached to it such as theft, impurities, or loss in designing. You can buy 22-carat gold or 24-carat gold through reputed jewelers in your city after checking the prevailing gold rate.

2. Digital Gold – In order to avoid safekeeping and storage issues in the above option, Gold can be digitally bought through various platforms online anywhere and anytime starting with INR 1. This gold is stored and insured by the seller on behalf of the customer.

3. Gold ETFs – Gold Exchange-traded funds (ETFs) are the funds that are traded and listed on Stock Exchanges – NSE and BSE. In other words, you can buy or sell these funds just like any stock of a company through a Demat account. The underlying asset here is Physical gold and stocks of Gold mining or refining companies. With Gold ETFs, you get to invest in gold and also enter into the share market.

4. Gold Mutual funds – Similar to Mutual funds, these funds are managed by asset management companies (AMCs). These funds do not directly invest in physical gold but invest primarily in Gold ETFs and related assets.

5. Sovereign Gold Bond (SGBs) – These are the guaranteed bonds by the Government of India which are issued by the Reserve bank of India (RBI) periodically as a substitute of Physical gold. Hence, these bonds can be purchased through Private and Public banks or Post offices in denominations of a gram of gold. However, RBI has also made these bonds available through Stockbrokers or through the Stock Holding Corporation of India Ltd (SHCIL) website.

This investment option has always been in light because it offers a fixed interest rate of 2.5% per annum to its customers. SGBs are long-term investments with a tenure of 8 years and a lock-in period of 5 years. If these bonds are sold in less than 5 years, then short-term capital gain tax gets applicable on the profits. However, after 5 years, there is no capital gain tax applicable on these bonds.

E. What can be the right choice of gold investment for you?

From the above read, you would have now got some insights about ways of gold investment in India. Let’s now compare these types of gold options on basis of various factors such as risk, expenses, returns, liquidity, etc.

| Physical Gold | Digital Gold | Gold ETF | Gold MF | SGB | |

| Risks | Impurities, Theft, Manufacturing loss | No Regulatory body such as SEBI, RBI | Market risk due to change in Gold prices | Market risk due to change in Gold prices | Sovereign default risk, debts risk of country |

| Expenses | |||||

| Design, Storage | 13-14% | 2-3% | Nil | Nil | Nil |

| Exit Load | Nil | Nil | Nil | 0.5-1.5% (in case of <1 year) | Nil |

| Expense ratio | Nil | Nil | 0.5-1% per annum | 1-2% | Nil |

| Broker charge | Nil | Nil | minimal | Nil | Nil |

| GST | 3% | 3% | 0% | 0% | 0% |

| Total expense in 5 years (E) | 16% | 5% | ~5% | ~10% | No visible expense |

| Additional interest (I) | Zero | Zero | Zero | Zero | 2.5% per annum |

| *For example, Let’s assume 10% increase per annum in gold prices for calculating Actual returns. | |||||

| Returns due to price increase in 5 years considering simple interest (R) | 50% | 50% | 50% | 50% | 50% |

| Actual returns in 5 years (R+I-E) | 44% | 45% | 45% | 40% | 62% |

| Liquidity | High | High | High | Moderate | Moderate |

| Required Minimum Investment | 1 Gram | INR 1 | 1 Gram | INR 500 | 1 Gram |

| SIP Options | No | Yes | No | Yes | No |

| Collateral for loan | Yes | No | No | No | Yes |

| Platforms to buy | Jewellers, Dealers, Banks | Augmont Gold, MMTC-PAMP INDIA, Safe Gold | Demat platforms -Zerodha, Groww, Upstox, others | Zerodha, Groww, Upstox, ET money, others | Banks, Post offices, SHCIL, Demat- Zerodha, Groww etc. |

The Sovereign Gold Bonds offer the highest effective returns among other options, hence it is always advisable to opt for Sovereign Gold bonds if liquidity is not your current priority. These bonds are regulated by the Government of India and also offer additional returns benefits compared to others. Therefore, SGBs are considered as one of best and safe way to invest in gold in India.

F. Final Statement

In conclusion, one can easily find out suitable gold investment option in India to allocate money in the gold portfolio from the above table. All these investment options we discussed above comes with unique features and financial benefits. Hence, investors who intend to have exposure to gold can try their hands at these diverse ways to invest in gold in India. On the basis of your investment goals, time horizon, and risk tolerance, you can choose your best option.

If you liked our article “Best way to invest in Gold in India | How to invest in it? “ then feel free to share it with your family, friends, and peers. Do share your thoughts on the article in the comment section below.