You must have heard the saying “Mutual Fund Sahi Hai”. It is getting more and more popular these days. A mutual fund is a go-to solution for people who want to invest in the share market but are too busy to do it on their own. Also, investing in Mutual funds is now easier than ever. All you need to do is download an app like ET Money, Groww, etc, and get started. These apps help you decide about the mutual fund you can invest in by showing various important factors like the Expense ratio of a mutual fund, past performance, sector-wise allocation of the fund, and many more.

All the factors stated on these apps are very important to consider while selecting a mutual fund. However, one of the most important factors is the Expense Ratio of the Mutual Fund. So in this article, we will tell you everything that you should know about the expense ratio.

WHAT IS THE EXPENSE RATIO IN A MUTUAL FUND?

The Expense Ratio is the fee that the Mutual Fund Company (Asset Management Company AMC) charges you to manage your investments. Its value changes from one mutual fund to another. This fee is not paid separately to the AMC but it is deducted from the investment value per day. The expense ratio includes the fund manager’s fee, operating cost, allocation charges, legal cost, etc. Hence its value will depend on the size of the mutual fund. Higher is the asset base lower is the expense ratio. The reason for this is explained below.

HOW TO CALCULATE THE EXPENSE RATIO?

It is calculated by the following formula:

Expense Ratio = (Total Expenses borne by the AMC)/ (Total Assets of the fund)

Total expenses = Operating Cost, Fund Manager’s fee, allocation charges, legal cost, etc.

Total Assets of the Fund = Total Value of investors’ money in that fund also known as Asset Under Management (AUM)

Example: Let us suppose that a mutual fund scheme has an AUM value of INR 100 Crores and it takes 1 Crore annually to manage the fund then the expense ratio will be = INR 1 Crore / INR 100 Crores = 1%.

Now If you invest INR 10,00,000 in this fund and your investment grows to INR 10,05,000 in a day then you pay:

Expense Ratio fee = (1%/365)*10,05,000 = INR 27.53 for that particular day.

You might think that 1% or 2% would not make much of a difference but let us calculate the Expense Ratio fee for the whole year in the above case

For 1 % expense ratio, the fee = INR 27.53*365 = INR 10,050.

For 2% expense ratio, the fee = INR 27.53*365*2 = INR 20,050.

Now, you will be able to understand the importance of the expense ratio when deciding on an investment. The critical thing to note here is that the expense ratio is not static but it keeps on increasing as the investment value increases since it is calculated as the percentage of the investment.

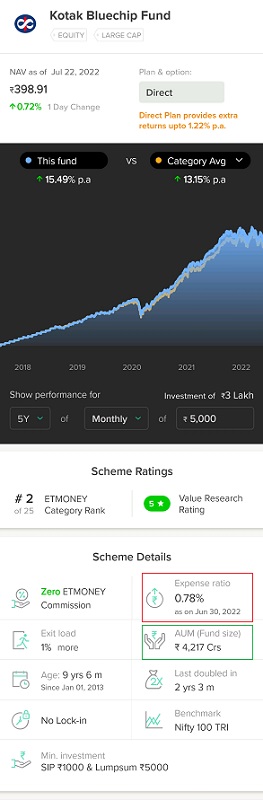

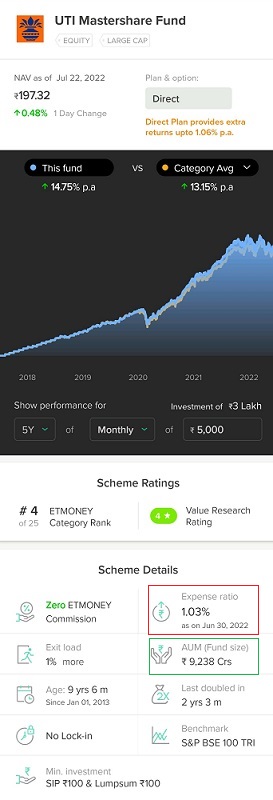

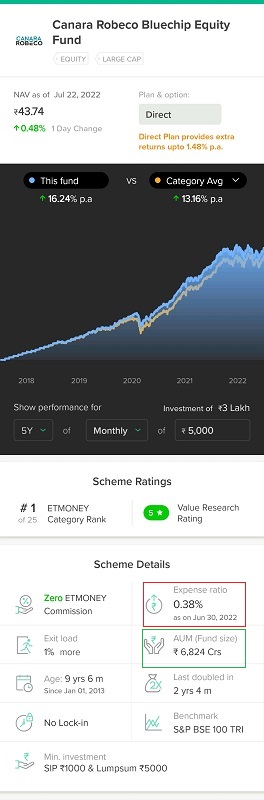

EXAMPLES OF EXPENSE RATIO IN MUTUAL FUND

In the above images, you can see the expense ratio value in the red box. In the green box, you can look at the AUM i.e. Asset Under Management values of the three mutual funds.

EXPENSE RATIO LIMITS

The Security and Exchange Board of India has put limits on the expense ratio that an Asset Management Company can charge from the investors based upon the AUM value of the Mutual Fund.

| Assets Under Management in Crores | Total expense ratio (TER) limit for equity schemes | Total expense ratio limit (TER) for other schemes |

| INR 0 – 500 | 2.25% | 2.00% |

| INR 501 – 750 | 2.00% | 1.75% |

| INR 751 – 2000 | 1.75% | 1.50% |

| INR 2001 – 5000 | 1.6% | 1.35% |

| INR 5001 – 10,000 | 1.50% | 1.25% |

| INR 10,001 – 50,000 | 0.05% reduction in TER for every INR 5,000 Crores increase in daily net assets | 0.05% reduction in TER for every INR 5,000 Crores increase in daily net assets |

| Above INR 50,000 | 1.5% | 0.8% |

WHY LOOK AT THE EXPENSE RATIO IN MUTUAL FUNDS BEFORE INVESTING?

Now let us look at why you should consider the expense ratio while deciding on the mutual fund to invest in.

- From the above calculation and examples, it is evident that the higher the expense ratio lower the returns earned. But it is not necessary that a mutual fund charging a high expense ratio is better than a mutual fund charging a less expense ratio.

- You can use the expense ratio as a deciding factor to choose between two mutual funds with other factors showing similar results. Choose the mutual fund with less value of expense ratio.

So folks, now you know everything about the expense ratio that you need to while selecting a mutual fund for investment. If you have any queries then do let us know in the comment section. Follow us on Instagram (wealth_drift) for valuable and easy-to-implement tips on personal finance.